Insurance

Secure Your Future with Confidence

USA / Canada / Any Country Travel Insurance

What is Travel Insurance?

Key Features of International Travel Insurance:

Emergency Medical Coverage Abroad

Covers medical treatment, hospitalization, and doctor visits if you fall ill or are injured overseas. This is essential because many domestic health insurance plans do not cover international healthcare.Medical Evacuation and Repatriation

Covers the cost of transporting you to the nearest adequate medical facility or back to your home country if necessary.Trip Cancellation or Interruption

Reimburses pre-paid travel expenses if you must cancel or cut short your trip due to covered reasons like illness, natural disasters, or political unrest.Loss of Passport or Travel Documents

Helps cover costs and assistance services if your passport or other travel documents are lost or stolen.Baggage Loss or Delay

Offers compensation for lost, stolen, or delayed baggage.Travel Delays or Missed Connections

Covers expenses such as hotel stays and meals if your trip is delayed.24/7 Assistance Services

Many policies include global hotlines that can help with medical referrals, legal assistance, and travel emergencies.

Tourists traveling abroad

Students studying overseas

Business travelers

Individuals on working holidays or long-term assignments

Monthly/person(40-70 Yrs)

-

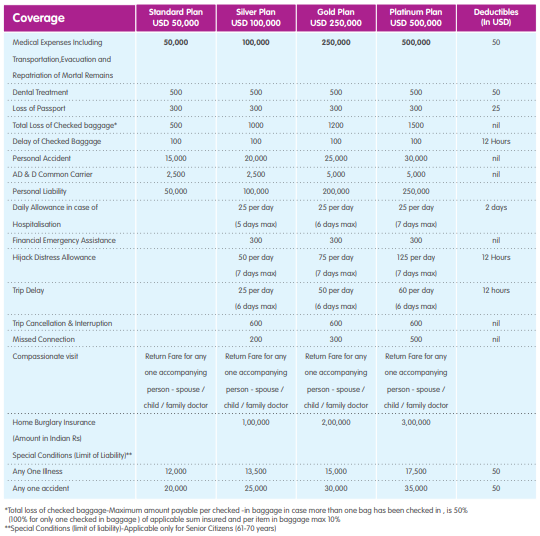

Standard $50,000

-

Silver $100,000

-

Gold $250,000

-

Platinum $500,000